Tds Challan From Income Tax Portal

Tds deposit new process through login of income tax portal|how to Tds tax2win source deducted E-pay tax : income tax, tds through income tax portal

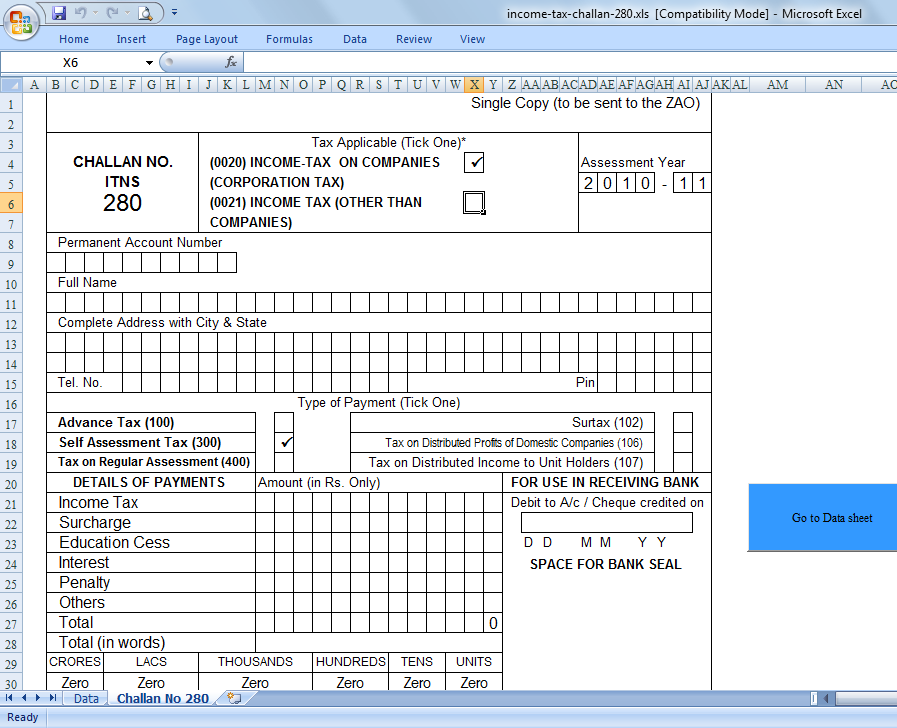

In & Out of E-TDS Challan 280, 281,282, 26QB – I. Tax Dept.|

How to generate challan form user manual Challan income payment receipt icici itr offline taxes code unable How to make the tds payment online?

Tds challan income tax portal

Tds return online filing on new income tax portal in englishIncome tax challan 281: meaning and deposit procedures How to generate challan form user manualTds online payment, income tax challan 281 online, traces login at.

Income tax e-filing portal : view tds formTax deducted at source (tds) under income tax- an overview How to download tds challan and make online paymentMere wrong mention of tan in tds deposit challan would not attract.

Tds payments through the income tax portal ii how to pay online tds ii

New registration of trusts, section 148 notices & tds/tcs changesHow to pay income tax through challan 280 View challan no. & bsr code from the it portal : help centerTds challan format in word fill out and sign printable pdf template.

How to download tds challan and make online paymentChallan tax counterfoil income payment online taxpayer quicko learn assessment self In & out of e-tds challan 280, 281,282, 26qb – i. tax dept.|Challan 280: how to make income tax challan 280 payment?.

Traces : view tds / tcs challan status

Income tax portal: higher tds/tcs on non-linked pan-aadhar to beTds filed quicko Tds payment challan excel format tds challana excel formatHow to download paid tds challan and tcs challan details on e-filing.

Tds tax deducted income due ay rates checked rate following chart overview link sourceChallan cin tds status traces number tcs select payment identification quicko bin check learn criteria period search go click option Correction in income tax / tds challan after paymentTds tax challan dept.

Income tax challan fillable form printable forms free online

How to pay tds challan by income tax portalChallan tds deposit vary subject Income tax challan 281 in excel formatTds challan payment income tax portal |how to pay tds online |tds.

How to download tds challan and make online paymentHow to generate a new tds challan for payment of interest and late Tds e-payment, challan, sections, certificates etc.,Challan 280 in excel fill online printable fillable b.

Challan income tax tds payment correction after

How to pay income tax challan online through icici bank .

.

Income Tax Challan 281: Meaning and deposit procedures

How To Pay TDS Challan by Income Tax Portal | TDS Demand Challan Pay by

Tds Challan Payment Income Tax Portal |How To Pay Tds online |Tds

TDS DEPOSIT NEW PROCESS THROUGH LOGIN OF INCOME TAX PORTAL|HOW TO

E - PAYMENT OR ONLINE PAYMENT 2.jpg)

Income Tax Challan 281 In Excel Format

View Challan No. & BSR Code from the IT portal : Help Center

E-pay tax : Income Tax, TDS through Income Tax Portal