How To Pay Challan No. Itns 280 Online

Online tax payment: how to use challan 280 for e-tax payment? Challan 280: how to pay your income tax online with itns 280 Challan no./ itns 280: details of payments for use in receiving bank

Challan 280 To Pay Self Assessment Tax Online AY 2019-20?

Challan no./ itns 280 Offline challan Income tax payment online using challan 280 step by step

Tax challan cleartax

Challan tds pay tcs quicko itns tin nsdlOnline tax payment: how to use challan 280 for e-tax payment? How can i pay my income tax online ?Pay your advance tax online in 5 easy steps.

Challan 280 to pay self assessment tax online ay 2019-20?E pay tax: how to use challan 280 to pay income tax online How to pay online tds/tcs/demand payment with challan itns 281Challan income.

Tax challan payment income online 280 pay information filing cleartax double step check

Challan 280 of income taxChallan tax jagoinvestor paying interest reciept Income tax challan 280 fillable formChallan 280 offline payment to pay income tax advance tax.

How to pay income tax that is due?Challan tax itns Challan tax online self assessment format income deposit form esic excel india vat ay companies select code than otherChallan pay icici bank online tax assessment self ay use banking banks shown example similar would screen.

Tax challan income itns corporation payment select online pay advance steps easy

How to deposit self assessment tax challan 280 online ay 2012-13It challan 280|advance tax pay itns no : 280 |taxpay individual pan no Challan receipt taxpayer paying bsr return cleartax itnsTax challan sbi cleartax assets1 quicko.

How to pay income tax online : credit card payment is recommended toChallan cleartax Challan 280 income assessment offline nsdlTax advance online challan pay payment steps easy.

Challan 280: online & offline i-t payment for self-assessment

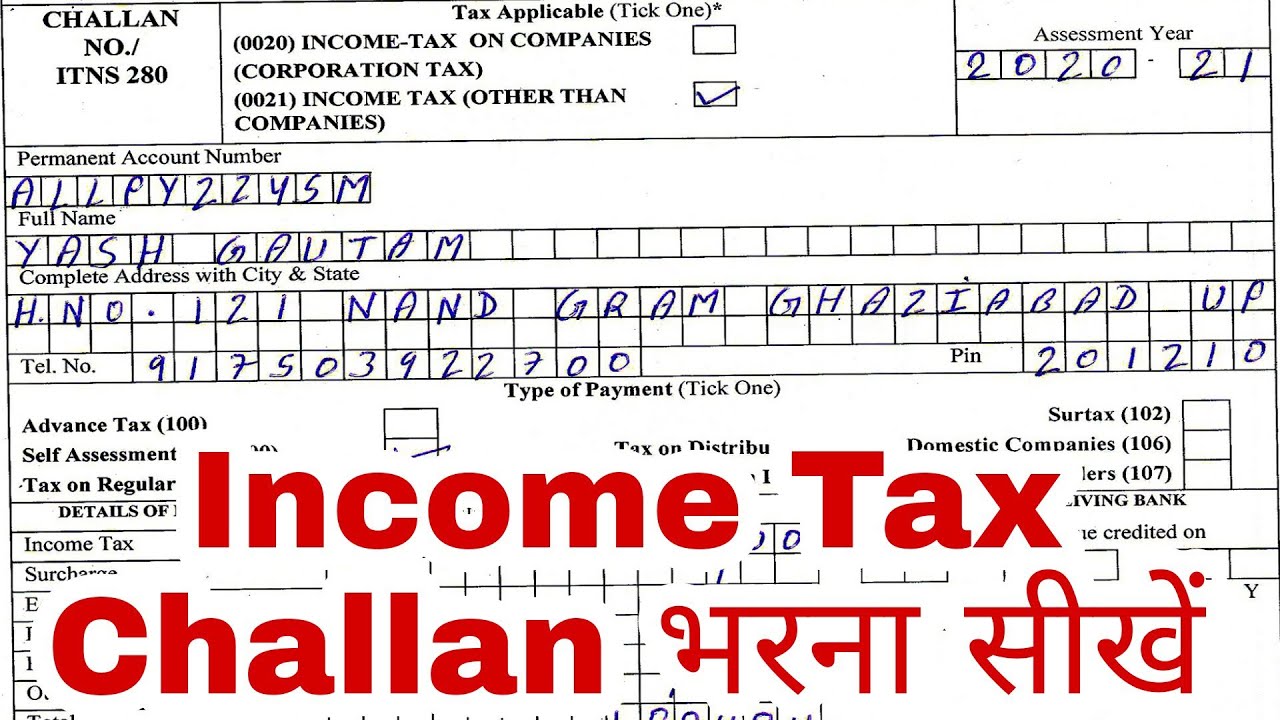

Download challan no itns 280 in excel formatChallan no./ itns 280 is required to be furnished at the time of Challan taxHow to fill income tax challan 280 offline.

How to pay income tax offlineHow to pay income tax online? challan itns 280 explained Challan 280 itns excel incomeSelect challan no.- itns 280 (payment of income tax & corporation tax).

Challan tax income online proceed option department network under information go click pay

Challan online tax assessment pay self ay fill step below useIt challan itns 281| how fill itns 281 challan online & offline?| pay Challan 280 to pay self assessment tax online ay 2019-20?Challan itns payment tds online tcs step head major pay demand appear contd form will required such fill details tax.

Challan 280: online & offline i-t payment for self-assessmentChallan 280: know how to use itns 280 to pay income tax online & offline Traces : pay tds / tcs challan online on tin-nsdl.

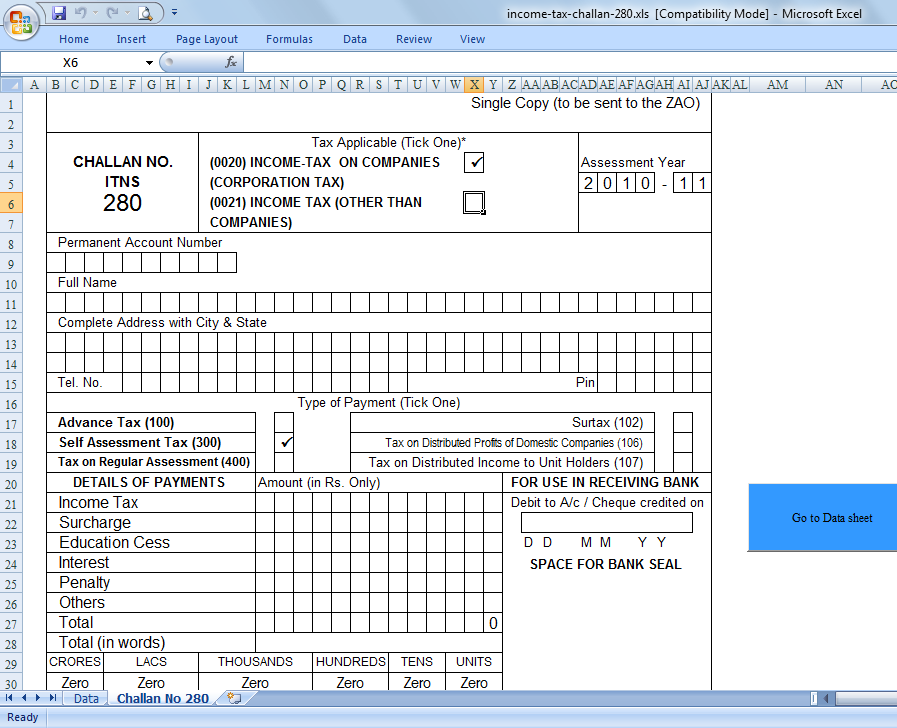

Income Tax Payment Online Using Challan 280 Step By Step - PELAJARAN

Challan No./ ITNS 280 is required to be furnished at the time of

Download Challan No Itns 280 In Excel Format - forallmetr

How can I pay my Income Tax Online ? - TAXAJ

How to pay Online TDS/TCS/Demand payment with Challan ITNS 281

Challan 280 - Income Tax Online Payment using Challan 280 - ITNS 280

Challan 280: Know How to Use ITNS 280 to Pay Income Tax Online & Offline